Winter storms can wreak havoc on Texas homes, leaving homeowners with extensive damage and challenging questions about how to navigate insurance claims. From freezing temperatures to unexpected snow and ice, these storms test the resilience of our homes and the coverage of our insurance policies. For Texans, understanding how to protect their property and manage claims effectively after a winter storm is critical.

This guide breaks down what winter storm damages are typically covered by homeowners insurance, common exclusions, steps to take after experiencing damage, and how to safeguard your home for future storms.

Common Winter Storm Damages Covered by Homeowners Insurance

Homeowners insurance policies often include coverage for many types of damages caused by winter storms. Here are some of the most commonly covered issues:

1. Wind Damage

Texas is no stranger to strong winter winds, which can tear shingles off roofs, damage siding, and even topple trees. Standard homeowners insurance policies typically cover wind damage, including repair or replacement costs for structural damage. For instance, if high winds cause a tree to fall onto your home, the policy would usually cover the cost of removing the tree and repairing the damage.

2. Hail Damage

Hailstorms are common in Texas and can leave behind significant damage to roofs, windows, and siding. Most policies provide coverage for hail damage. Documenting the damage with photographs and keeping maintenance records can make the claims process smoother.

3. Water Damage from Burst Pipes

Freezing temperatures can cause pipes to burst, leading to water damage inside your home. Most homeowners insurance policies cover water damage caused by sudden and accidental pipe bursts, provided that homeowners took reasonable precautions, such as insulating pipes or maintaining heat in the home.

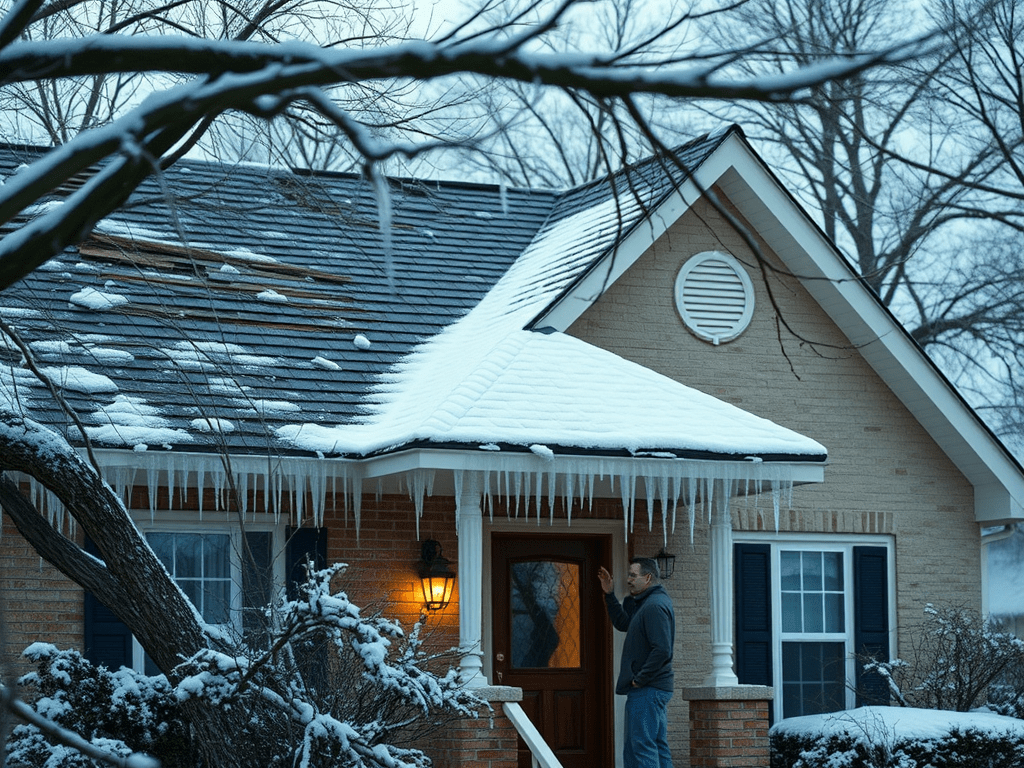

4. Roof Collapse from Snow or Ice

Heavy snow or ice accumulation can strain a roof to the point of collapse. If this happens, your insurance policy will likely cover the damage. However, the damage must be sudden and not due to neglect or pre-existing issues with the roof. If this does happen, check out our article on the steps to take afterward if you have roof damage.

5. Damage to Personal Property

If a winter storm damages personal belongings inside your home, such as furniture or electronics, these losses are often covered under the personal property section of your policy. However, coverage limits may apply, so it’s essential to review your policy details.

Exclusions and Limitations to Winter Storm Coverage

While many types of winter storm damage are covered, there are notable exclusions and limitations that homeowners should be aware of:

1. Flooding

Damage from external flooding caused by melting snow or ice is typically not covered under standard homeowners insurance policies. To cover flooding, homeowners need a separate flood insurance policy through the National Flood Insurance Program (NFIP) or a private insurer.

2. Gradual Water Damage

Water damage that occurs gradually over time, such as leaks or seepage, is generally excluded. For instance, if a small crack in a pipe goes unnoticed and eventually causes damage, your claim may be denied.

3. Mold

Mold remediation is usually not covered unless the mold results directly from a covered event, like a sudden pipe burst. Even then, coverage limits may apply, and additional endorsements may be needed for full protection.

4. Negligence

Insurance companies expect homeowners to take reasonable precautions to prevent damage. If the insurer determines that negligence played a role—such as failing to fix a known roof issue before a storm—the claim may be denied.

Steps to Take After Winter Storm Damage

If your home sustains damage during a winter storm, following these steps can help you navigate the insurance claims process effectively:

1. Document the Damage

Start by taking clear, timestamped photographs and videos of all affected areas, including structural damage, water stains, and any destroyed personal property. Visual evidence is critical for supporting your claim.

2. Prevent Further Damage

Once it is safe to do so, take temporary measures to prevent additional damage. For example, cover broken windows with plastic sheeting or tarp a damaged roof. Keep receipts for materials purchased for these temporary fixes, as insurers may reimburse you.

3. Review Your Policy

Understanding your policy’s coverage limits, deductibles, and exclusions is essential. This knowledge will help you set realistic expectations when discussing your claim with the insurer.

4. Contact Your Insurance Company Promptly

File your claim as soon as possible. Many insurance companies require homeowners to report damage within a specific timeframe. Provide them with all necessary documentation, including photos and a detailed description of the damage.

5. Keep Detailed Records

Maintain a log of all interactions with your insurance company, including the dates and times of calls, names of representatives you speak to, and summaries of the conversations. Keep copies of all emails and claim-related paperwork for future reference.

6. Work with a Public Adjuster if Necessary

If you’re overwhelmed or feel your insurer is undervaluing your claim, consider hiring a licensed public adjuster. Public adjusters advocate for homeowners and can handle the negotiation process to help you secure a fair settlement.

Preventative Measures to Protect Your Home from Winter Storms

Taking proactive steps can minimize the risk of damage from future winter storms. Here’s how:

1. Insulate Pipes

Install pipe insulation or heat tape on exposed pipes to prevent freezing. Focus on pipes in unheated areas, such as attics, basements, and crawl spaces.

2. Seal Gaps and Cracks

Inspect your home’s exterior for gaps or cracks where cold air can enter. Use caulk or weatherstripping to seal these openings.

3. Maintain Heating Systems

Have your heating system serviced annually to ensure it’s in good working condition. A well-maintained system reduces the risk of freezing pipes and keeps your home comfortable during cold spells.

4. Trim Overhanging Branches

Regularly trim trees near your home to reduce the risk of branches falling during storms. This step can prevent damage to your roof, siding, and windows.

5. Inspect and Repair Your Roof

Check your roof for loose or damaged shingles and repair them promptly. A well-maintained roof is less likely to sustain damage during a winter storm.

Understanding Policy Changes and Premium Adjustments

The increasing frequency and severity of natural disasters, including winter storms, have prompted many insurers to adjust their policies and premiums. In Texas, homeowners have seen:

- Higher Premiums: Rising claims costs have led to increased premiums for many policyholders.

- Higher Deductibles: Some policies now include percentage-based deductibles for wind and hail damage, which can result in higher out-of-pocket costs.

- Stricter Policy Terms: Insurers are adding exclusions and requiring additional endorsements for specific types of coverage, such as water backup or mold remediation.

Staying informed about these changes is crucial. Regularly review your policy with your insurance agent to ensure you have adequate coverage for potential risks.

Key Takeaways for Texas Homeowners

Winter storms pose significant risks to homes across Texas, but preparation and knowledge can make a world of difference. Here’s what every homeowner should remember:

- Know Your Coverage: Review your insurance policy regularly to understand what is covered and what is excluded. Consider additional endorsements if needed.

- Be Proactive: Take preventative measures to protect your home from storm damage, such as insulating pipes and maintaining your roof.

- Act Quickly: Document damage and file claims promptly to avoid delays or disputes with your insurer.

- Seek Help When Needed: Don’t hesitate to consult a public adjuster or attorney if you encounter challenges during the claims process.

By staying informed and prepared, Texas homeowners can navigate the challenges of winter storms with confidence and protect their most valuable asset—their home.